celestamaclana

About celestamaclana

Finest Dangerous Credit Score Personal Loans: A Complete Case Research

In at present’s financial panorama, securing a personal loan might be difficult, especially for people with bad credit. Unhealthy credit score can come up from various factors, including late payments, excessive credit score utilization, or even bankruptcy. However, there are still choices obtainable for those in want of monetary assistance. When you cherished this post in addition to you desire to receive more information with regards to personalloans-badcredit.com kindly stop by our own web page. This case examine explores one of the best bad credit score personal loans, examining their features, professionals and cons, and how they might help borrowers rebuild their credit score whereas assembly their monetary needs.

Understanding Bad Credit Personal Loans

Bad credit personal loans are specifically designed for people with low credit score scores, sometimes under 580. These loans can be used for numerous purposes, corresponding to debt consolidation, house repairs, medical bills, or unexpected financial emergencies. Lenders providing these loans usually consider elements beyond just credit score scores, comparable to earnings, employment history, and overall monetary well being.

Key Options of Dangerous Credit Personal Loans

- Higher Curiosity Rates: One of many most significant drawbacks of unhealthy credit personal loans is the higher curiosity rates compared to loans for borrowers with good credit. Lenders charge higher charges to offset the danger of lending to people with a historical past of default.

- Versatile Loan Amounts: Many lenders supply a range of loan quantities, permitting borrowers to decide on an amount that greatest fits their needs. This flexibility might be helpful for those who may only want a small quantity to cover an emergency expense.

- Shorter Repayment Terms: Unhealthy credit personal loans usually include shorter repayment terms, usually starting from one to five years. While this could result in greater month-to-month payments, it additionally allows borrowers to repay their debt extra shortly.

- Secured vs. Unsecured Options: Borrowers could have the choice to choose between secured and unsecured loans. Secured loans require collateral, corresponding to a automobile or savings account, whereas unsecured loans do not. Secured loans might offer lower interest charges but include the chance of dropping the collateral if funds are not made.

High Lenders for Unhealthy Credit Personal Loans

- Upstart: Upstart is a web based lender that makes use of artificial intelligence to assess creditworthiness past simply credit scores. This method allows them to offer loans to borrowers with unhealthy credit score. Upstart gives loans ranging from $1,000 to $50,000 with repayment terms of three to five years. Curiosity rates can range considerably however typically vary from 6.76% to 35.99%.

Pros: Quick utility course of, flexible credit criteria, and no prepayment penalties.

Cons: Larger interest rates for borrowers with poor credit score and restricted customer support choices.

- OneMain Monetary: OneMain Financial specializes in personal loans for borrowers with bad credit score. They provide secured and unsecured loans ranging from $1,500 to $20,000, with repayment terms of two to five years. Curiosity rates typically vary from 18% to 35.99%.

Pros: Native branches for in-individual assist, versatile payment options, and no prepayment fees.

Cons: Higher curiosity charges and restricted on-line presence compared to different lenders.

- Avant: Avant is an online lender that caters to borrowers with credit score scores as little as 580. They offer loans from $2,000 to $35,000 with repayment terms of two to five years. Curiosity charges vary from 9.95% to 35.99%.

Pros: Quick funding, user-pleasant online platform, and flexible loan amounts.

Cons: Increased curiosity rates and an origination charge might apply.

- BadCreditLoans.com: This platform connects borrowers with varied lenders willing to work with individuals with dangerous credit score. Loan amounts range from $500 to $5,000, and repayment terms range by lender. Curiosity rates could be high, typically exceeding 35%.

Professionals: Large community of lenders, quick software process, and the power to compare a number of affords.

Cons: Excessive-interest rates and potential for predatory lending practices.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper permit borrowers to acquire loans from particular person traders slightly than conventional monetary establishments. This may be a wonderful option for those with bad credit score, as buyers could also be willing to take an opportunity on borrowers with much less-than-perfect credit score histories.

Execs: Potentially lower interest rates compared to traditional lenders and a extra private lending experience.

Cons: Longer approval instances and the necessity to satisfy specific standards set by buyers.

Professionals and Cons of Unhealthy Credit Personal Loans

Professionals:

- Access to Funds: These loans present access to much-needed funds for people facing financial challenges.

- Credit Rating Improvement: Making well timed funds on a foul credit personal loan may help enhance credit scores over time.

- Number of Uses: Borrowers can use these loans for various purposes, from consolidating debt to protecting unexpected expenses.

Cons:

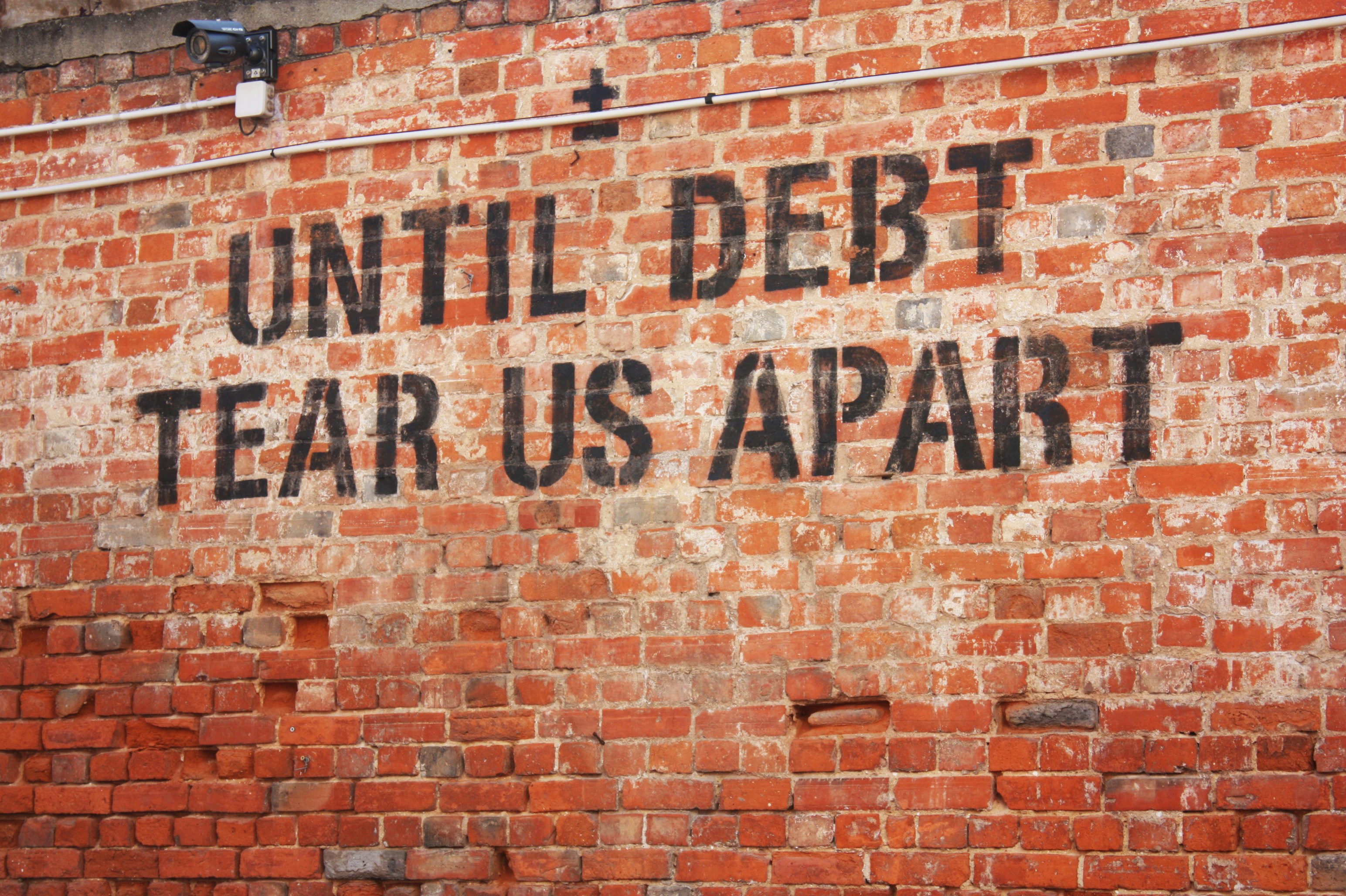

- Excessive Interest Charges: Borrowers could face exorbitant curiosity charges, leading to larger overall repayment quantities.

- Threat of Debt Cycle: If not managed correctly, taking out a foul credit personal loan can result in a cycle of debt, particularly if borrowers take on extra loans to cowl current debt.

- Restricted Options: Borrowers with bad credit could have fewer choices and may have to settle for less favorable terms.

Conclusion

Dangerous credit personal loans could be a lifeline for individuals dealing with financial difficulties. Whereas they come with their very own set of challenges, comparable to larger curiosity charges and shorter repayment phrases, they also provide a possibility for borrowers to entry funds and enhance their credit score scores. It is important for borrowers to fastidiously evaluate their choices, examine lenders, and understand the terms before committing to a loan. By making informed decisions and managing their finances responsibly, people with unhealthy credit score can navigate their monetary challenges and work towards a more stable financial future.

No listing found.